The Vaultification of DeFi: Crypto Structured Products and Their Future

Options, Derivatives, DeFi Vaults, and Shake Shack

You’re going fast. You’re on your way back to the mothership. You feel a little bloated from the shake shack you ate before the trip but luckily I, your crewmate, have been sharing my pop with you to help you digest. Even though you ate it before boarding, the whole ship smells like burgers since you brought 15 more shake shack burgers along. Your plan isn’t to eat them but to give them to your buddy on the mothership to see if they could reverse engineer the recipe. If this pans out you guys will open up a franchise and make a killing. You’re hopeful and feeling gluttonous.

But until then, you’re focused on the task at hand. You’re returning back from a year-long expedition on earth with your crew. Each crewmate was tasked with reporting back about how humans are progressing in certain areas like politics, medicine, and technology. You were tasked with reporting on how money is evolving. You’re preparing to share your research report from this expedition on earth. You think this crypto structured products trend will replace investment banks & will be a turning point for this decentralized finance thing going on on earth so you’re excited to share.

While digesting you give the English translation a once over:

Introduction

The crypto structured products space is set to suck up so much TVL the gods of liquidity will be forever shooting blanks. Crypto structured products give users access to pre-packaged high-returning investment strategies, usually built on 1 or more derivatives. This is huge for retail attraction as the complexities of these strategies are stripped away from the users who are simply presented with a clear pay-off structure and risk profile to fit their needs. They’re also great for DAOs to earn a passive income stream on their treasury assets while maintaining desired exposure to their holdings. The source of these yields is potentially some of the most sustainable yields in DeFi since they don’t depend on any sort of token emissions.

In this article, we’ll cover what a crypto structured product even is, why you should care, current protocols that are operating in the space, and a sneak peek into the future of what could be offered. So let’s dive in!

A Primer on Crypto Structured Products

A crypto structured product is a pre-packaged investment vehicle that abstracts away yield-bearing strategies. The specifics of what does and doesn’t count as a structured product are quite broad but there’s a common structure we see in DeFi that we’ll focus on:

Vaults that take user deposits and use those funds to execute some automated strategy to earn users yield

They're usually built on derivatives so the performance of the strategy is at least partially dependent on what that derivative does or doesn’t do over the duration of the vault

This is very abstract but I promise I’ll expand more as we go along.

Currently, Crypto Structured Products are having their moment with TVL on the largest protocols in the space at or nearing ATHs while the rest of DeFi is lagging behind their ATHs.

As of the end of 2021, this was the ecosystem break-up of that growth:

With the success of Crypto Structured Products like Ribbon Finance and Friktion, it’s clear there is strong demand for simple and intuitive structured products that give users automated exposure to a set of varied yield strategies. By far, the most popular type of structured products are DeFi Option Vaults (DOVs). These execute option writing strategies on behalf of the depositor. Let's get into it!

Ribbon Finance

Ribbon finance is a pioneer in the structured products space launching some of the first DOVs. As the first movers in the space, they have garnered the lion’s share of TVL sitting at $268M at the time of writing.

Their flagship product is their Theta Vaults which essentially abstract away on-chain options writing strategies and finding counterparties so users can earn yield in the form of premiums.

Currently, Ribbon’s Theta Vaults employ two main options writing strategies for users to earn premiums on selling Covered Calls and Put Selling.

Covered Call Strategy

There are two main components to the covered call strategy: Your underlying asset (which you’re long by virtue of holding), and the call option you’re selling against that asset.

When you sell a call option, you’re agreeing to sell a certain amount of an asset at a set price (known as the strike price) to the option buyer. Specifically, with European Options that Ribbon mints, the option buyer can only exercise that option at the time of expiry. The goal in selling this call option is that the option expires without reaching that strike price (called expiring out-of-the-money), thus the option buyer has no incentive to exercise the option. This is where the yield comes from because if it expires out-of-the-money you get to keep 100% of your underlying collateral plus the premium you were paid when selling the option.

When you deposit assets into Ribbon, they underwrite call options against your asset for the same amount and sell those options into the open market. This is a fully collateralized option which is generally considered safer as a partially collateralized option exposes the writer to theoretically unlimited risk.

Your biggest risk is the options you’ve sold expiring in-the-money. This is the scenario where the strike price is surpassed and the options buyer chooses to exercise the option to buy. The is not a loss per se (denominated in USD) but an underperformance vs. holding the asset because you would be exposed to all the upside of the asset until it hits the strike price, in which case you’ve sold the remaining upside and the buyer of the option is entitled to the difference between the assets price and strike price multiplied by the number of options bought.

An Example: let’s say ETH is at $3000. You collateralize a 1ETH call option with a strike price of $3500 which is set to expire in a week. You sell it off for $100.

At expiry, if ETH is worth less than $3500 the option has expired worthless and you get your 1 ETH back + the $100 the buyer paid you for the option. In fact, you would love an expiry at $3,499 since your position would be now worth $3599.

If ETH is at $4000 at the time of expiry, the option buyer is entitled to the difference between the strike price of $3500 and the expiry price of $4000. So if you were simply long ETH, your 1 ETH position would be worth $4000 but in this case, you would need to forfeit that extra $500 to the option buyer. Leaving you with $3600 ($3500 +$100 premium) or 0.9ETH.

All in all, your pay off structure would look something like this (for an ETH covered call):

Optimal Market conditions: The asset moves sideways, down, or rises moderately. The best-case scenario is for the underlying asset to rise just enough to stay out-of-the-money so depositors can pocket gains on the asset + premiums.

Supported Assets: $SOL, $WBTC, $ETH, $stETH, $APE, $sAVAX, $AVAX, $AAVE

Put Selling

Similar to covered calls, you’re writing an option and selling it off for premiums with the hope of them expiring worthless. But in this case, you’re writing a put option. When you sell a put option you’re agreeing to buy an asset at a strike price below the current price. You’re betting the underlying asset doesn’t fall below that price and you get to keep your underlying asset as well as the premium that was paid to you through selling those options.

Again, you can outperform holding the underlying asset but if the price of that asset falls below the strike price, you will lose money as you’re on the hook to pay the difference between the strike price and asset price.

All in all, your pay off structure would look something like this:

Optimal Market conditions: The asset moves sideways, up, or falls moderately. The best-case scenario is for the underlying asset price to stay flat or increase so depositors can comfortably get 100% of their deposit back + premiums.

Supported Assets: USDC against AVAX, USDC against ETH, yvUSDC against ETH

What happens on the back-end?

Every Friday at 11pm UTC, Ribbon will take the vaults deposits from the previous week and deposit those as collateral into Opyn to mint oTokens. These are on-chain options that ribbon mints with parameters including maturity date (usually 7 days from mint) and strike price (calculated algorithmically). Ribbon sets a minimum price for those oTokens then hosts an on-chain gnosis auction to sell them into the market. At the end of the duration of the contract, users can then withdraw funds. If the options expire in-the-money, then users can withdraw a portion of their initial deposit + premiums. If the options expire out-of-the-money, users can withdraw their entire deposit + premiums earned.

The only exception to this with Ribbon V2 is that the SOL covered calls mints call options depositing its SOL balance as collateral in a ZetaMarkets FLEX vault as opposed to an Opyn vault.

Thoughts on DOV Yield

Personally, I see Ribbon as a protocol taking user liquidity and deploying it in innovative ways to provide core services that keep DeFi running. In the case of Ribbon, that is providing a steady stream of option liquidity on-chain. Because of that, they are responsible for the most options volume on Ethereum; previously, a hard problem to crack. You’ll continue to see this trend with other structured products we cover.

Because users earn yield on Ribbon via premiums, not emissions, and those premiums are based on actual utility; I consider Ribbon and similar products to be amongst the most sustainable yield in DeFi. I’d put it up there with trading fees earned by LPs and interest earned by lenders.

StakeDAO

StakeDAO is truly an aggregator of yield. Starting out as a yield aggregator similar to Yearn on Ethereum, they have aggressively expanded into every type of yield from arbitrage vaults, to Staking-as-a-service, and of course options vaults. Currently, they support various strategies across Ethereum, Harmony, BSC, Polygon, and Avalanche.

Similar to Ribbon, they support covered call strategies (ETH, BTC, LINK, UNI, AAVE) and put selling strategies (Frax against ETH). They use Opyn to mint their options and auction them off on a weekly basis OTC to market makers via Airswap.

There are a couple of key differences that make StakeDAO’s options vaults interesting:

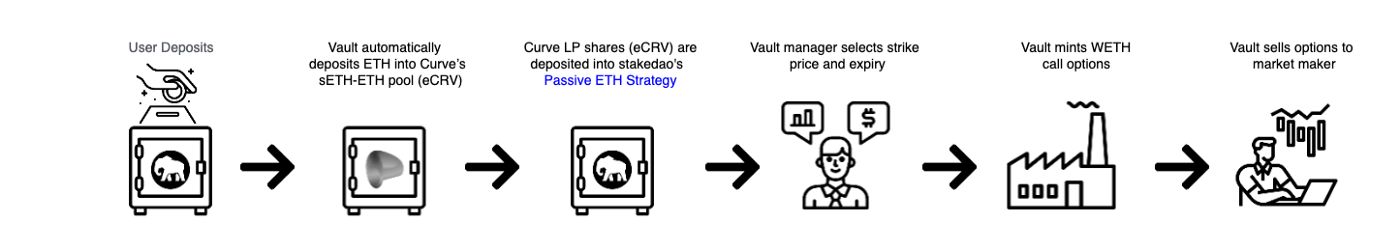

In order to boost the yield earned on these DOVs, StakeDAO introduces an extra step in the process. Before minting options against your underlying asset, StakeDAO deposits your underlying into another yield earning strategy they have, then writes European Options against the LP token collateral in those vaults. Meaning not only do you earn yield on the option premiums but also on the vault strategy.

For example, StakeDAO has a “Passive ETH Strategy” vault that deposits ETH into Curve’s sETH-ETH pool (eCRV) and auto compounds LP fees for you. When you deposit ETH into their covered call strategy vault, they first deposit your ETH into Curve’s ETH-sETH pool to get eCRV, then deposit those eCRV LP tokens into their passive ETH strategy vault to get sdeCRV. StakeDAO then mints call options against that sdeCRV collateral and sells them off.

Covered Call Payoff Diagram. Source: Opyn/Wade Prospere

If you really want to juice up that yield, StakeDAO allows you to stake the LP token you get back from depositing into their option vaults to earn their SDT tokens. All in all, your APR on the options vaults, if you’re staking, is (Weekly Options Writing Yield *52 weeks) + Passive Strategies APR + SDT Incentives APR.

Source: StakeDAO

Unlike some of Ribbon’s vaults, StakeDAO sells all of its options OTC to market makers. This allows them to collateralize and sell their options with more exotic assets like sdeCRV.

Side note: StakeDAO has a particularly interesting focus on building on top of the Curve ecosystem. They support a ton of curve-based assets/strategies and their treasury is ~80% locked-CRV and aCRV. To me, this is attractive since solid treasury = solid project.

Ondo Finance

Ondo Finance is a structured product protocol on Ethereum. While their focus is on LP tokens and not derivatives, the fundamental idea is the same as Ribbons: use deposited funds to provide liquidity to traders.

On a high level, Ondo allows users to deposit single assets, then pairs them together to provide liquidity DEXs to earn liquidity fees on those assets over the lifecycle of their vaults.

So how do Ondo vaults work?

When a new vault is launched, it has a subscription period (roughly 30-days) where users can deposit two types of assets into their vaults, one called the Senior Token and the other called the Junior Token. The Senior asset (usually the more stable/liquid of the two) will earn a fixed annualized APY and the junior asset will earn a variable annualized APY. These rates are set before launch.

Once the subscription period is over, deposits are closed and the vault moves into deployment which has its own duration of roughly 30-days. Since these assets are meant to be pooled together to provide LP they need an equal value amount of each asset so if one asset is oversubscribed to, they return the difference back to the users. LIFO style. Their strategy then deposits both assets into a vault-specified DEX as liquidity to start earning trading fees and auto-compounds earnings on the users behalf.

Finally, after the deployment period comes the redemption period where users can redeem their deposits + yield. This is where the fixed interest rates are realized. Of all the yield earned from the vault, it first goes to returning the fixed-rate promised to senior token providers and all excess yield goes to junior token providers. Senior token providers are relatively shielded from IL risk which is passed on to the Junior token providers but you can learn more about that here under return scenario.

Along with trading volume and pool liquidity, the returns of these vaults are still very much so dependent on the price performance of the underlying assets. Without getting into that, Let’s try an example out with USDT-ETH.

Vault Params:

Duration: 30-days

Asset Pool: USDT(senior)-ETH(Junior)

Number of Positions and Relative Size: $2M on Sushi.

Return Split: USDT earns 10% fixed APY, ETH earns 50% variable APY (Subject to change)

The vault raises all $1M of each asset, and deposits both assets into the Sushiswap USDT-ETH pool for the next 30 days.

Again, way oversimplifying by ignoring price, but a few scenarios for how each depositor can earn. Notice we’re referring to APY and not APR since the vault auto compounds.

The vault clears the fixed interest rate hurdle comfortably.

Let’s say that vault returns like 100% annualized APY. The returns would first go to satisfying the USDT depositor's 10% annualized interest rate hurdle. The rest of the gains would go to ETH depositors to claim with their collateral.

The vault just clears the fixed interest rate hurdle.

For example, the vault earns 11% annualized. USDT depositors earn 10%, and the ETH depositors earn 1%.

The vault under-performs the fixed interest rate.

Let’s say the entire vault somehow only earns 5% annualized APY over its deployment period. All of that 5% of the APY will go to the USDT depositors and the ETH depositors would just get back their collateral.

Hopefully, it’s clear that the junior token provider takes on more risk in these vaults but is exposed to a ton more yield upside than the senior provider.

All-in-all, Ondo is interesting because it abstracts away the complexities and risks of providing paired liquidity in an easy-to-consume structured way. The team clearly has their sites on grander visions as well. Hint hint: Ondo has no token atm ;)

Non-Ethereum-based DOV Protocols

Friktion

Friktion is the largest DOV protocol on Solana. After launching in mid-December 2021, its TVL has already grown to $115M, up from $66M at the end of December. They offer 14 covered call strategies and 6 put selling strategies whose options they auction off to on-chain market makers via their RFQ system (@channelrfq). Friktion has covered call strategies for ETH and BTC collateral as well as Luna, FTT, SOL, and various Solana DeFi ecosystem tokens.

Katana

With a team of some of the best builders in DeFi, Katana launched mid-december after winning the Solana Ignition hackathon earlier in 2021. They’ve grown to the #2 spot of structured products protocols on Solana with a TVL of $29M. Their offering is similar to Friktion’s in that they support a wide variety of assets across 11 covered call strategies(SOL, SRM, ETH, RAY, etc) and 3 put selling strategies (WBTC, WETH, and SOL).

Katana has numerous partnerships with DAOs like @InvictusDAO, @god_dao, and @InjectiveLabs to offer passive strategies for their treasury assets. They also just announced their $5M seed round backed by the likes of Framework Ventures, Alameda Research, mgnr, CMS capital, and Coinbase Ventures.

ThetaNuts

ThetaNuts is the most pervasively cross-chain DOV protocol offering vaults on Ethereum, BSC, Avalanche, Polygon, Fantom, Boba, Cronos Network, Moonbeam, Oasis, and Aurora. They currently have a TVL of about $41m with $30m of that on Ethereum mainnet. Thetanuts supports put selling and covered call strategies for the native token of each chain at minimum, (WFTM on Fantom, WAVAX on Avalanche, etc) which is a great entry point for each chain’s respective users.

The Future: Vaultification of everything

OK, this is the fun part. Let’s explore new projects and possibilities in the space.

Other options writing strategies

One easy extrapolation of what is happening now with DOVs is that more options strategies beyond covered calls and put-selling will be structured as DOVs. These types of strategies introduce new risk profiles and pay-offs for more types of investors.

Two I’ll explore here: Short Strangles and Short Straddles.

Short Strangles

A short strangle is when an options writer sells both a covered call option and a put option for the same asset with the same expiration dates but with different strike prices. The covered call strike price and the put strike price essentially act as bounds for your profit where if the underlying asset is above the put strike price and below the call strike price, then you're returned 100% of your collateral as well as premiums on both options sold. Essentially, the writer of the option would be neither bullish nor bearish but instead bet against a certain amount of volatility of the asset over the lifetime of the option.

In the context of crypto, users should be able to collateralize both options with the same collateral (instead of splitting the collateral down the middle to secure each option individually) since it is impossible for the collateral to be on the hook for both options. At the moment, I don’t know if there are any options protocols that could support something like that. It’s also worth noting that since usually covered calls are collateralized by the underlying asset and puts are collateralized by stablecoins, the specifics of how this could be implemented are not as straightforward since we’d ideally want to use the same collateral for both. One project I know of that will be enabling functionality like this is @rysk.finance.

Short Straddles

A short straddle is when an options writer sells both a covered call option and a put option for the same asset with the same expiration date *and strike price*. The best-case scenario is that the option expires exactly at the strike price, in which both options expire functionally worthless and the writer gets their collateral back + premiums earned on both options.

Similar to the short strangle, the writer of the option is short volatility but the risk of loss is higher as you’re defining a tighter range. In return for that additional risk, the writer can earn more in premiums for this if successful than with the short strangle.

Others DOV Strategies

Another interesting strategy is the bull put spread which could help hedge a spot position. Another one is the iron condor strategy, which is another market-neutral short-volatility strategy.

If you’re interested in learning about other common options strategies check these out:

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies

Keep in mind a lot of these are options buying strategies but similar strategies can be constructed on the sell-side with opposite pay-off profiles.

PPNs: Principal Protected Notes

The next step in our exploration into the future of structured products is a further trek into isomorphism by looking at TardFi structured products for inspiration.

A common structure we’ll see in TardFi is structured products with bonds as a core component. The idea is to take the guaranteed yield from that bond and place it into something with a higher upside potential such that in the best case scenario you make more gains than simply investing your entire principal into the bond and in the worst case you get your entire principal back and no loss in incurred (other than opportunity cost). These are called Principal Protected Notes, as they guarantee to return at least the principal if held to maturity.

For example, let's say there’s a bond that offers 10% guaranteed returns with a maturity date of one year. A structured product offered by a bank might take an initial investment of $10,000, invest $9100 into the bond and $900 into say a 10x leveraged long S&P500 position. By the end of the year, if that $900 gets liquidated, the bond still matures and earns you that $910 back, leaving you with $10,010. Pretty much the same as you started. If the leveraged trade is successful, let’s say S&P500 is 10% above entry at bond maturity (ignoring interest payments), then you get your underlying principle of $10,010 back from the bond plus the returns from your leveraged position which would be ~$1800. This would total a return of $11,810.

I’m not sure what the formal names of these are but let’s call the bond the “fixed yield investment” and the other asset the “risk investment”. Now we can take this template and apply it to a lot of protocols across the beautifully composable landscape of DeFi.

Fixed Yield Investments: Where can I find fixed yield in DeFi?

Olympus Pro Bonds Marketplace - a marketplace to buy bonds from Olympus Pro Partners like Alchemix, Frax, Synapse, and more

Fixed Interest Rate Protocols (Note fixed yield does not mean guaranteed yield)

Risk investments: Where can I find high-risk high-upside derivatives in DeFi?

Options Protocols: Dopex, Premia, Opyn, Ribbon(?)

On-chain leverage trading: GMX (offers on-chains on-chain leveraged positions)

Perps: Squeeth (we will talk more about this later)

Using these protocols, you could mix and match to create crypto versions of PPNs. Say 88mph is offering 15% fixed interest on deposited ETH, we could vaultify a strategy that deposits 90% of funds into 88mph and uses 10% of funds to invest into some higher upside ETH derivatives like a leveraged long ETH position on GMX or Squeeth. Then at the end of the year, you’ll find yourself with either a little bit more ETH than your started or a lot more ETH than you started depending on the performance of ETH vs. USD.

To keep this closer to the ground and palatable, let’s try to construct a strategy with $OHM. Using the data available at writing, we could build a strategy that used every other rebase from a staked $OHM position (3,3) to buy as many call options as possible at the nearest strike price available on Dopex. I use the rebases since $OHM bonds are negative atm.

$3000 initial investment

OHM 5-day rebases are sitting at around 3%

1,000.00 gOHM call options @ $4000 cost around 1.925 OHM ($63.5, 10-day maturity)

You can view my rough modeling here.

TLDR: denominated in $OHM, you’re implementing something which guarantees more than a PPN strategy. If $OHM manages to hit 40% above your buy-in at expiry, your 100 OHM is now 6,466 OHM. Which is pretty interesting. This example is strictly illustrative, there’s a bunch of caveats:

Dopex has no liquidity for this trade. We can’t actually buy that many call options at the moment, but I think the pricing would be the same if we could.

I’m denominating in OHM, obviously that only appeals to ohmies

I didn’t model the opportunity cost of giving up every other rebase or really annualize anything, this is just looking at one 10-day period.

This is half-assed and probably wrong but I just wanted to get the juices flowing here. Even if this setup is a complete dud, there are definitely PPN strategies that would work. Hit up @hussufo to tell him why I’m wrong or build on these ideas.

UXD, Lemma & Delta-Neutral Basis Trading Vaults

Background knowledge: A Primer on Perpetual Contracts.

Lemma finance and UXD Protocol are structured products on Arbitrum and Solana, respectively, that offer users market-neutral yield in the form of basis trading strategies.

Perpetual Futures are derivative contracts that give the holder the right to buy an asset at any point in the future. Similar to Synths, perpetual futures are meant to keep their price pegged to the underlying asset denominated in USD (ie, ETH/USD). The way the price of a perp stays pegged is through a dynamic funding rate, which is the fee paid in some interval by the opener of the more popular trade to the funder of the less popular trade. When the price of a perp deviates above the index price of the underlying asset, that means there are too many long positions open vs. Short positions. So funding rates will be positive, meaning anybody with an open long position will be paying a funding rate to the shorter. The more it deviates the higher the funding rate to be paid, this incentivizes both longs to close positions and shorts to open up positions to earn that funding rate and stabilize the price.

Basis Trading is a market-neutral strategy where a user will take advantage of positive funding rates (longs are paying shorts) by opening up a short position on an asset and holding an equal amount of that asset in spot. This effectively gives the user 0 exposure to the underlying assets price action but they will receive funding from longs when funding rates are positive.

What do UXD & Lemma’s vaults do?

UXD/Lemma’s basis trading vaults implement an on-chain basis trading strategy on behalf of depositors. When you deposit ETH into UXD or Lemma, the protocol automatically routes your funds to a Decentralized Derivatives Exchange, keeps half of your ETH in spot, and uses the other half to open up a short position to start earning funding on. Effectively turning your ETH position into a stablecoin position. The LP Token you get back in return for depositing into these vaults is actually a stablecoin pegged to $1 ($UXD on UXD Protocol, $LUSD on Lemma), which of course is backed by the delta-neutral position held by the minter.

With Lemma, funding yield is distributed back to depositors (LUSD minters). With UXD, funding yield is distributed to UXD Protocol Stakeholders and their insurance fund which exists to protect UXD holders from paying funding rates when/if they turn negative.

In the future, I think the demand for delta-neutral structured products will increase considerably.

Wake up babe, a new money lego just dropped: Squeeth

What we’ll continue to see is that as new DeFi primitives are launched, they will present entirely new opportunities to build structured products on top of them. Like Opyn’s oToken primitives and Ribbon! One such primitive is Squeeth, launched by Opyn & Paradigm in January 2022.

In short, Squeeth is a perpetual contract with a price that is pegged to ETH^2. The Price of ETH in USD to the power of 2. It is an incredibly cool experiment and you can learn more about its intricacies here.

With the launch of Squeeth, many people’s minds were exploding with the possibility of what a new on-chain primitive with such an interesting pay-off structure could enable. Let’s touch on a few below.

Crab Strategy

Just launched recently, Opyn’s crab vaults work similarly to basis trading strategies. The vault’s strategy essentially pairs a short Squeeth position with a long ETH position in order to earn yields on funding rates while being in an approximately delta-neutral position.

Like the short straddles discussed above, you’re betting against volatility here. The vault rebalances positions daily to ensure that the amount of ETH is enough to cancel out the ETH exposure from the short Squeeth position. To be specific, the vault is betting that the volatility between each daily rebalance will be less than the implied volatility of ETH. Thus if ETH stays within that range over the day (~6% in either direction), you’re in the green. Conversely, if the implied volatility is realized before the next rebalance in either direction, you would lose money on the trade.

You can learn more about the crab strategy here and here.

Bull & Bear Strategies

While I couldn’t get much info on specifics, Opyn will also be launching similar auto-rebalancing strategies on top of Squeeth targeting Bulls and Bears and offering Delta 1 and Delta -1 exposure respectively.

Read more here.

LP-hedging Strategies

A considerable issue with providing liquidity to DEXs today is impermanent loss. LPs want to earn fees by providing liquidity without giving up their upside on one or both of the assets.

It turns out there are strategies that almost perfectly hedge the value of an LP position using a basket of LP Tokens, Squeeth positions, and other derivatives (Perps and/or options). You can construct hedges against Squeeth/ETH pools, ETH/USD pools, and any ETH pool and earn trading fees while minimizing downside risk. Learn more about hedging Uniswap v3 positions with Squeeth here.

Given how attractive a solution to impermanent loss is, there will definitely be protocols that emerge to actively manage Uniswap v3 LP positions using active rebalancing and hedging IL using derivatives like Squeeth, Options, etc.

P.S. keep an eye on fuerte.fi, they’re developing several delta-neutral strategies w Squeeth, on-chain options, perps

Alkimiya - Hashpower structured products

Alkimiya is an incredibly interesting protocol aiming to turn hashpower into an on-chain commodity.

The problem today is that network validators, miners on proof-of-work chains, are exposed to a ton of volatility in their earnings for validation. As a miner, for example, it may cost you a fixed amount to run a mining rig, but the fees that you earn in exchange for validating the network depend on the demand for blockspace over that month as well as the price volatility of the underlying asset you’re earning.

This is where Alkimiya comes in with the goal of allowing validators to swap hashpower for a fixed amount up front. Alkimiya just launched this week on Avalanche with their Silica Contracts and Hash Vaults coming Q2022.

Silica

Silica is a commodity swap contract designed to facilitate the buying and selling of hashpower. Anybody can create a contract that says I’d like to sell X amount of hashpower for Y fixed price delivered over Z period of time. What the seller of the contract is actually doing is saying, in exchange for Y fixed price, I will deliver the rewards that I’ve earned for mining X amount of hashpower.

Once the swap is executed, a fixed payment of stablecoins that the seller bought the silica for will vest over the duration of the contract while the seller pays all rewards earned from validation, based on the network’s consensus algorithm, over the same duration.

Since it doesn’t actually matter whether the seller is actually mining or not, you could think of these as hashpower derivatives.

This is all pretty abstract so here’s is an example pulled from their docs:

For example, a miner running 10Gh/s of Ethash pays $2,000 every month for hosting. In a bear market where the miner wants to protect against the downside, the miner can issue a N Gh/s over 30 days Silica @ 2,000 USDT (N < 10). Every day the miner is expected to deliver (N * Reward_Per_Gh/s_Per_Day) number of ETH, in exchange for a portion of the 2,000 USDT. The Basis Reward Index tracks the number of ETH 1Gh/s produced on a given day.

The benefit to the miner is they are able to remove uncertainty by locking in payments upfront. Which allows them to build a more predictable business.

Hash Vaults

Hash Vaults are structured products that are composed of a strategic portfolio of silica.

It’s not clear what strategies they plan to launch with but the overarching theme is that these vaults will provide users with an easy way to invest directly in blockspace rewards. It’s known that blockspace gets bid up during times of high activity like NFT mints or airdrop claims, resulting in higher fees for validators during those times. With hash-vaults, you can gain exposure to those fees or as they put it: “take a directional bet on event-driven network congestion and profit off these expected events.”

This is pretty frickin exciting. These earnings are currently only accessible to node operators, but now can be accrued by other pleb humans.

Learn More:

Conclusion

In conclusion, the humans are doing some magical stuff down on earth. Hopefully, you’ve learned a bit about what the crypto structured products landscape looks like today and what it might look like in the near future. Crypto structured products are step-function improvements in user experience for both end-users and DAOs to be able to access passive yield strategies. As a result, they place a key role as capital aggregators in the ecosystem whose deployment strategies serve as core liquidity to provide core services in DeFi. We will definitely see more of this in the future. Or as the human put it, we’re bullish on crypto structured products.

Shouts out @wadepros. I wouldn’t be able to write this without his incredible medium articles. Thanks to @0xbosta for the feedback and editing on such short notice.

As usual, anything I’ve said (well technically you’ve said) above is probably wrong and I’d be more than glad for you to tell me why! All feedback welcome, hmu @hussufo.

gm and gn

Great piece