The future of Synthetic Assets: TardFi On-chain and a Larger Casino

Synthetic Assets, Benevolent Oracles, and Blow-up Dolls

Synthetic assets (and I'm not talking about these things) are token derivatives whose price mimics the price of something else. It’s how we’re able to have $1 DAI = $1 USD, mTSLA = price of 1 TSLA share, and sBTC = 1 BTC all on-chain.

But that’s just the vanilla stuff. Synthetic assets can be made to mimic literally anything and offer instant exposure to any asset imaginable. Imagine trading tokens that track crypto indexes, Real Estate, or your favorite e-girl’s OnlyFans subscribers all on Uniswap. Well, synthetic assets allow you to do all of that and more.

In this post, I’ll explain how synthetic assets work today, explore synthetic tokens being used in the wild, and offer a glimpse into the many types of financial products that you could buy in the future.

But First:

A primer on Synthetic Assets

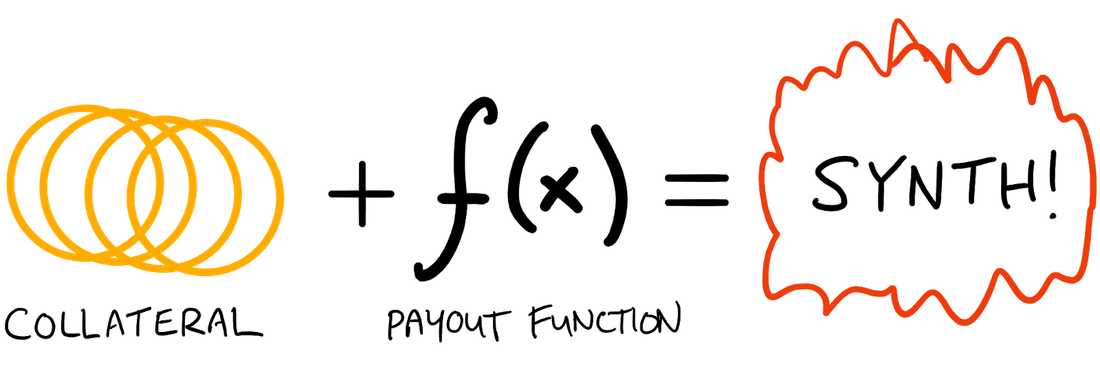

Synthetic assets, or synths, are derivative tokens whose price is pegged to some other on-chain or meat-space asset. A key distinction is that they aren’t backed by the underlying asset itself. You don’t need to deposit said asset to mint it on-chain like you need to do with say WETH or Paxos’ PAXG (which is backed by literal gold bars that Paxos holds). Synthetic assets can be minted using any type of collateral.

A simple example of a synth is sBTC, an ERC-20 token by Synthetix that is equal to 1 BTC in price.

Most synths today work relatively simply. Most follow the MakerDAO model of minting DAI which is a stable coin pegged to $1 USD:

First, you deposit collateral, say ETH, into Maker and you can mint DAI against your collateral as a loan. This is called a Collateralized Debt Position (CDP). At the moment, the Maker Protocol requires generally a 150% over-collateralization on any CDP. Meaning if a user wants to mint 500 DAI they need at least 1.5x that (so $750 worth of ETH) as collateral. To get your collateral back, you’ll need to repay the 500 DAI + some interest which will burn the DAI you’ve borrowed out of existence.

If your collateralization ratio falls below 150%, i.e. your $750 worth of ETH is now worth less than that, you risk getting liquidated and losing all or a portion of your collateral. Trust me when I say that there is an army of bots itching to liquidate your position the second they can.

This mechanism allows for arbitrage opportunities if DAI ever loses its peg.

If DAI ever goes above 1 dollar, then arbitrageurs can mint DAI for a dollar and instantly sell into the market at a profit. This increase of supply and sell pressure helps eventually reduce the price.

If DAI ever goes below 1 dollar, then people with outstanding loans can buy DAI at a discount and burn it on Maker to unlock their collateral at a profit. Conversely, this decrease of supply and added buy pressure helps eventually increase the price.

This game of incentives aligns all participants from the protocol, minters, liquidators, and open market participants to keep 1 DAI = $1.

This is also how most synths are minted and price pegs are maintained. Instead of minting stablecoins pegged to $1, you can peg your synths to any price you want. As long as you have collateral, a protocol, and a price oracle, you can mint a synth of any asset imaginable.

Let’s take a fictional example, Huss Protocol, that mints HTC as a synth of BTC. I can deposit $150 worth of ETH and Huss protocol issues me $100 worth of HTC at a 150% collateralization ratio. Now I can do whatever I want with that HTC and as long as there is a liquid market for HTC, arbitrage and liquidation incentives should keep the 1 HTC pegged to 1 BTC.

To obtain synths, you can also buy synths on the open market instead of minting them.

Synthetix

Synthetix is probably the most well-known and respected pioneer in the synthetic asset space. It’s a protocol for the minting and trading of synths built on Ethereum (I’m pretty sure they came up with the name ”synths”). They are responsible for synths like:

iBTC - which inversely tracks the price of BTC, for the bears

sBTC - which tracks the price of BTC, for the bulls

sDeFi - which is an index of a basket of blue-chip DeFi protocols

A variety of currency synths like sJPY, sGBP, sUSD, and sEUR

The way Synthetix enables users to mint synths is similar to the model I’ve described above but with 2 key differences. One, you stake SNX tokens to mint synths and need to keep a *checks notes* 600% collateral ratio on your assets. Two, it works on a shared debt pool model. Meaning the SNX you’ve staked is thrown into a monolith pool with all the other stakers and any debt you mint against that collateral represents your share of the entire system’s debt pool.

I won’t go into too much detail here but you can read more about it in the docs. TLDR; for you, this means both your upside and your downside on a given position are throttled as they’re socialized across all stakers in the system. For the system it means the stakers act as a “pooled counterparty” to trades which mitigates counterparty risks and slippage and ensures liquidity for trading.

Mirror

Mirror is a protocol built on the Terra Network that allows users to trade synthetic equities. With no KYC, any user globally can long or short stocks 24/7 like mAPPL, mABNB, mFB, and mGOOGL.

Minting one of these assets is closer to the regular MakerDAO model we’ve outlined. Any user can deposit the stablecoin UST and mint any supported mAsset against it. They are expected to keep a collateralization ratio between 110-150% depending on the asset, set by governance. They mitigate counterparty risk by using yield to incentivize users to take both the long and short positions on any given asset.

This is a game-changer for users that normally couldn’t get easy access to trading US stocks. I read somewhere that their biggest user base is actually in Thailand.

Enter Universal Market Access: UMA Protocol

UMA, standing for Universal Market Access, is leading this space in the most interesting direction I could imagine. The UMA protocol is a key money-lego in the synth space due to one innovation: The Optimistic Oracle.

If you’ve been reading up until this point, it might have dawned on you that the biggest blocker to minting any synth is an Oracle. For us to build synths based on other assets, we need an on-chain oracle so we know what the price of a synth should be. Synthetix and Mirror get around this by using Chainlink and Band Protocol respectively. But they are limited to whatever financial data those protocols choose to support. How about when we want to track more obscure stuff like the floor on the top 10 rarest CS:GO skins? Chainlink isn’t going to get that on-chain any time soon.

Well with UMA’s Optimistic Oracle, you can kind of do that. It’s designed to not be an on-chain price feed but an escalation game for price disputes. When you request a price from UMA’s Oracle, you essentially post a bounty for the price you're looking for and the reward you’d like to give. Anybody, called a proposer, can then upload a price and stake a bond with that submission. It’s optimistic because it assumes that the price is correct until proven otherwise. If all is well, the proposer gets their bond back as well as the bounty reward (which can be zero).

But there is some predefined liveness period, say 24 hours, where disputers (anybody) have the opportunity to dispute the price submitted before sending it back to the requestor. A disputer must also submit a dispute with a staked bond. In the case that a price is disputed, the dispute escalates to UMA’s Data Verification Mechanism (DVM).

This is essentially just UMA’s governance token holders voting on what the actual price was and who was right. If the token holders determine the proposer was right, they get the reward and their bond back, and the disputer loses their staked bond. Conversely, if the disputer was deemed right, the disputer gets the reward and their staked bond back, and the proposer loses their bond. In this coordination game, truth is ultimately uncovered. This might sound tedious but it’s designed such that most price responses aren’t disputed.

In the case of minting synths using UMA, any liquidator who thinks a CDP is no longer in good standing needs to request a price update on UMA’s oracle to update the loan’s state and perform a liquidation. So if any actor feels a liquidation has been done unfairly, they can submit a dispute about the price reported with UMA and the DVM will figure it out.

Their optimistic oracle has spawned an entire ecosystem of protocols building on top of it from Synthetic assets to novel incentive mechanisms:

Our beloved Dopex Protocol relies on UMA to mint synths for their decentralized options trading protocol

Boba Network’s WAGMI incentives program uses UMA to unlock $BOBA rewards at certain TVL milestones for developer partners that build on their network

PieDAO uses UMA for KPI-based token unlocks, 30% of their supply is unlocked incrementally and distributed to stakers the more $DOUGH tokens are staked.

BTCDOM is a synth that allows users to trade a Bitcoin dominance index

The team at Yam Finance uses UMA to mint; $uSTONKS which tracks the ten most bullish Wall Street Bets stocks (deprecated), $uPUNKS which tracks the median transfer price of all CryptoPunks transferred over the last 30-days, and $uGAS synthetic futures contract that settles to the 30-Day Median Ethereum Gas Price so can hedge gas.

Across Bridge leverages UMA’s Optimistic Oracle to enable instant bridging between Ethereum and Layer 2 Rollups like Optimism, Boba, and Arbitrum

The future: Decentralized TardFi and the Giga-casino

I probably don’t need to preach to you how DeFi will eat up TardFi. But to add some perspective, the derivatives market is huge. You’ll often hear some wild estimates thrown around but the gross market value of OTC derivatives was $12.6 trillion in the first half of 2021. There’s no reason why DeFi can’t absorb some of that demand and more.

Derivatives

The opportunity exists for decentralized counterparts to thrive for all types of derivatives traded on the market today. The existing derivatives market is generally split up into two types: Derivatives traded on exchanges and Derivatives traded Over-The-Counter (OTC). While derivative contracts on the OTC side can be a lot more variable, the underlying assets are relatively consistent among both types; equities, bonds, commodities, currencies, interest rates, and market indexes. All of which can be tracked and theoretically minted on-chain.

We’re already seeing a decentralization of exchange-traded derivatives like Options and Futures. As mentioned before, Dopex Protocol has built an incredible decentralized options trading protocol on Arbitrum and is just getting started. DeFi juggernaut, dYdX recently cleared $2 billion in daily trade volume on their perpetual (futures that never expire) exchange on StarkNet.

Regarding OTC derivatives, it’s a large fragmented space with many types of bespoke derivatives being traded. The underlying ability for synths to track a given asset is there though. The different types of contracts commonly traded OTC will be unbundled and it’s up to new protocols to create offerings that appeal to those institutional customers and enable access to smaller players.

Indexes

As we know, dollar-cost-averaging into the S&P500 is a very popular strategy for passive investors. Mirror already has mSPY that tracks the S&P500 and if there’s a market for it, more indexes will be minted as Synths. What’s interesting is that now anybody can create an index of a basket of assets from stocks (ie, FAANG coin) to crypto-assets (like sDEFI) and more.

ForEx

The forex trading market is $6.6 trillion and its decentralized counterparts are already being adopted. Synthetix allows users to mint and trade currencies like sJPY, sGBP, sUSD, and sEUR. South-African chad Andre Conje’s FixedForex leverages the CDP model to mint interest-bearing currency synths, offers 0-fee swaps, and currently boasts $300 million in liquidity for those synths.

Real estate

The opportunity to speculate on real estate can be opened up to people who don’t explicitly own any real estate. I can see a world where users can buy a synth tracking things like the average sale price of a 4-bedroom home in orange county over the last 28 days and more.

User-generated Financial Products

This is all good and well but I think synths will open up even more opportunities for speculation and make crypto an even larger casino. New markets will be discovered and more participants will be engaged.

At the end of the day, it’s a small subset of the population that gives a fuck about crypto or novel financial instruments. People want to invest in what they know, and as all gamblers know, slapping money on top of every game makes it 100x more fun and engaging (and devastating).

I have a friend group that fucking loves sports betting. Is it because they are degenerate gamblers? Yes. But also, it’s because they love sports. They eat, sleep, and drink the shit and this is just a fun way to speculate on games. They get together, watch games, place bets, and either win together or watch each other spiral out. It’s amazing. Me? I’ve never fired up a BET365 account because I could give a fuck less about sports.

What do I care about? Music, technology, and big titty anime girls. Why can’t I long Kanye’s first-week album sales against Drake’s? I would have lost money but I’d still do it even in retrospect. Why can’t I speculate on the viewership growths of up-and-coming artists? Or buy an index tracking the stream count of the top 10 artists in a new genre that will spread like a crackhead at a stop and frisk? I would love that.

That’s just me. Many more markets will be discovered of things that people love from fun games to activism:

Game of Thrones geek? Place binaries on the next episode’s death count.

People that binge make-up tutorials could speculate on the follower count of some up-and-coming makeup brand their noticing pop-up more.

Hate a certain Twitch streamer? Short their average peak concurrent viewer counts on their last 10 live streams.

Hypebeasts could trade a token that tracks the 30-day average sale price of Supreme Box Logo Tees on Grailed and StockX.

I’m sure there’s some SimpFi application here.

Somebody actually built this on UMA: A literal shit coin that “tracks the frequency of poop sightings as reported by San Francisco's SF311.”

As long as there’s a liquid market for these assets, the sky’s the limit.

Conclusion

Hopefully, you’ve learned a little bit about how synths work and all the new ways people will discover they’ve got a gambling problem. I think the future will look something like what I’ve outlined above but there is still a long way to go. For one, the current CDP model is quite capital intensive and is susceptible to large bank-run scenarios. Two, obviously, crypto in general needs to be more accessible and user-friendly. And three, liquidity. If synth makers want to make their synths useful, synths need liquidity. Creating liquid markets for every obscure synth is not easy.

Either way, I’m sure we’ll get there!

Anything I’ve said above is probably wrong and I’d be more than glad for you to tell me why! Feedback welcome, hmu @hussufo.

gm and gn

Google GNS, 150x crypto and 1000x forex, defi on polygon with 100M market cap. It made all other protocols like perp or dydx obsolete.