Intro

It’s been widely thought that stablecoins are one of crypto’s killer apps. The type of offering that is so attractive, it brings hordes of new users into crypto to use it. Given that stablecoins make up 25% of the top 20 tokens by market cap, I’d say this is a fair assessment. But one glaring problem with stablecoins is that during highly inflationary environments that erode purchasing power, like the one we’re in today, holding them is very unprofitable.

There’s a new alternative primitive that threatens stablecoin dominance with a unique-to-DeFi offering that solves for this unprofitability and maintains purchasing power regardless of inflation: CPI tokens.

CPI tokens are tokens whose price changes at the same rate as the Consumer Price Index, in essence acting as an inflation-resistant stablecoin. A truly stable-- coin that attempts to protect purchasing power over any arbitrary timeline. In this post, we’ll cover a bit of background about the CPI and inflation, why the success of CPI tokens could change the DeFi landscape drastically, and dive into two protocols building towards this vision: Volt and Frax.

What is the CPI?

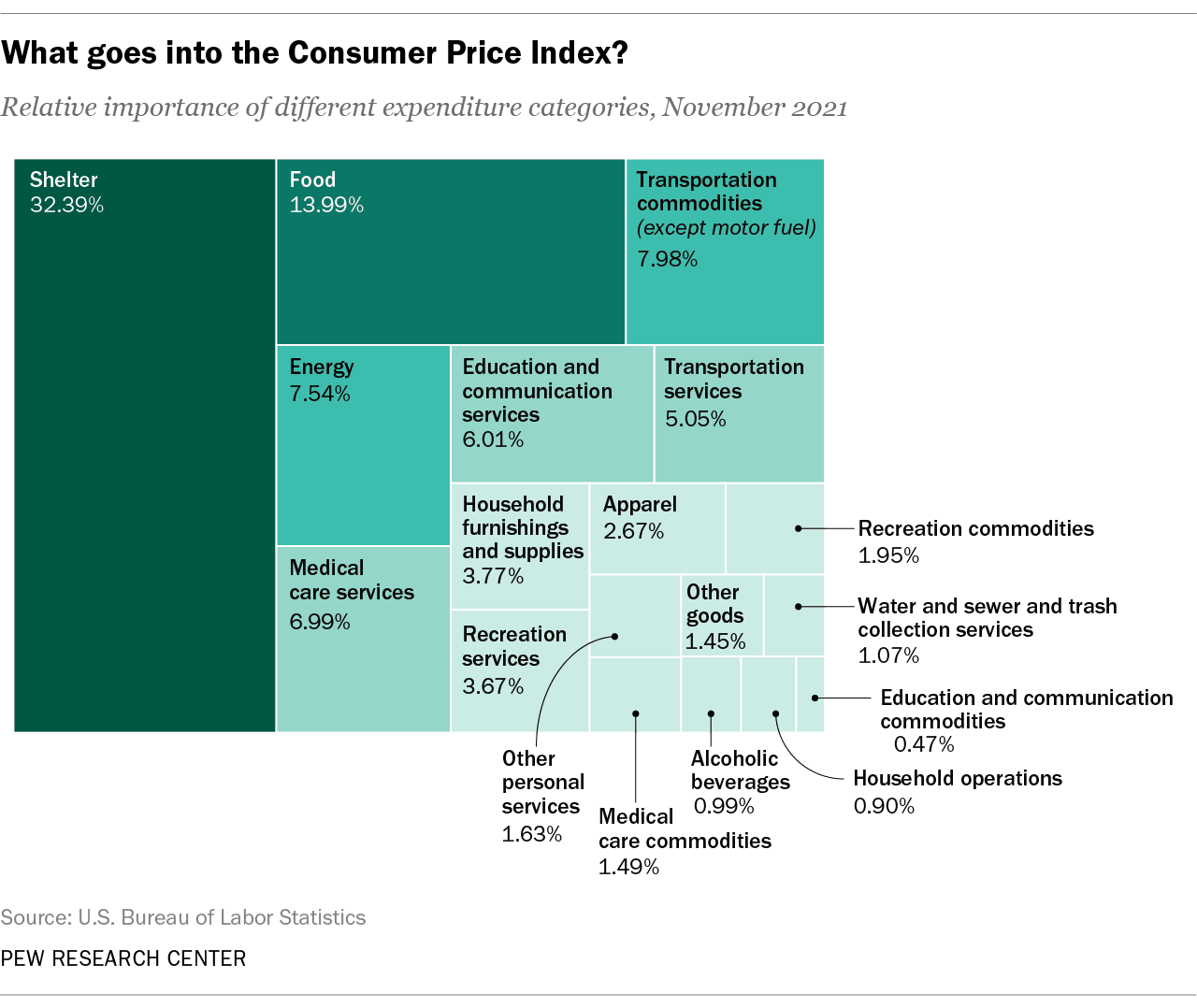

The Consumer Price Index is a statistic published regularly by the US Department of Labour that tracks the average changes in prices that consumers pay for a basket of goods and services. Put another way, it’s a way to capture the change in the cost of living over time. The CPI is calculated using a weighted average of price changes for things like shelter, food, transportation, energy, gas, clothes, etc. It looks at things like how much the price of a pound of bacon or a pint of beer has changed over the years (the cost of bacon is up 18.6% from last year btw).

Why should I care?

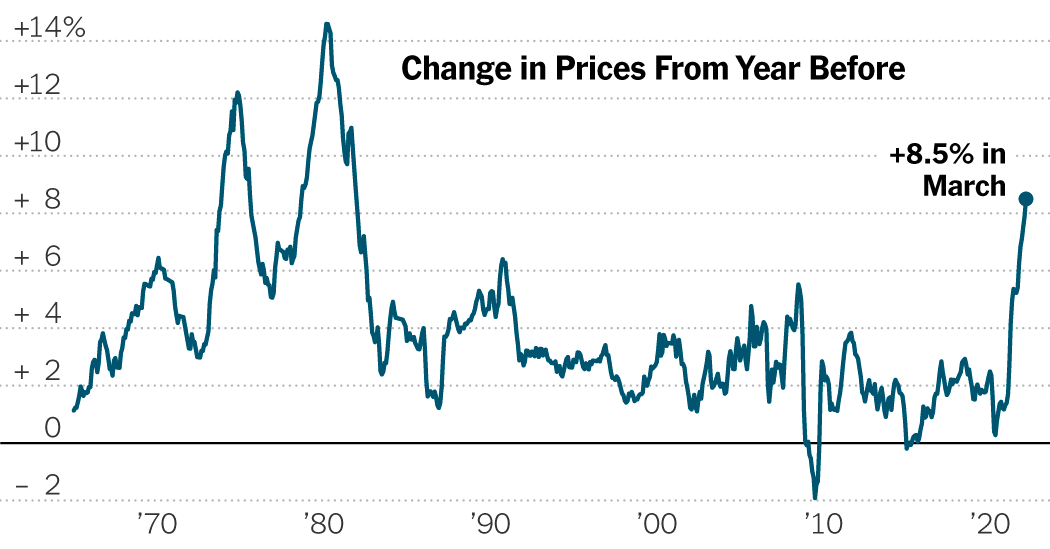

FED money printer went BRR. COVID introduced plenty of supply constrictions across many day-to-day purchases we make. Interest rates are low enough that demand for certain assets (housing, cars, etc) has increased simultaneously. The annual inflation rate in the US accelerated to 8.5% as of March 22’. Last week, the Dept. of Labor reported a sharp increase in CPI of 8.5%. Folks are starting to feel their cost of living go up. Complaining about gas & grocery prices is a meme.

All of this means if you’re sitting in stables or saving in fiat, your purchasing power is quickly dwindling. Put another way, you’re actively losing a non-trivial amount of money. One question that everybody is asking is; where do I park my money to, at minimum, protect my purchasing power?

Therein lies the problem and the opportunity. Fiat and fiat-pegged stablecoins are no longer reasonable stores of value along almost any time horizon. Regular people have few places to go to simply protect their existing capital without going risk-on or exposing themselves to relatively-high volatility.

This is the opportunity that CPI-pegged tokens are positioned to tackle.

CPI Tokens

CPI tokens are tokens whose price change is pegged to the change in CPI. Meaning if a single CPI token is worth $100 at the beginning of the year and the CPI has risen 12% by the end of the year, at the end of the year the CPI token’s price will be $112. This goes on in perpetuity, acting as an inflation-resistant stablecoin and serving the actual use of a stablecoin: a low-volatility, highly liquid way to maintain purchasing power.

The advent of these types of tokens is a pretty huge deal.

To date, stablecoins seem to have done an incredible job of onboarding new users to crypto by offering a way to reap the benefits of DeFi without volatility exposure. But given the increased demand for liquid ways to curb inflation, sitting in stables simply won’t cut it anymore. So the crypto investor has two options: they can buy CPI tokens and passively earn inflation on their stable portfolio or they can very actively manage their stable portfolio by jumping from yield strategy to yield strategy with the goal of beating inflation. This is to say that a savvy yield farmer can often beat inflation on their stables but due to the natural dilution and variability of those yields, that portfolio would have to be actively managed and subject to frequent reallocations to the next best farm.

CPI tokens effectively act as yield-bearing stablecoins where the yield is reflected in the token’s price appreciation. Because of this, I see CPI tokens replacing stables as the position of last resort for a stablecoin portfolio. The baseline of passive stable returns. Meaning if you aren’t willing or able to beat inflation by actively managing your stable portfolio, the default position is no longer holding stables or depositing into some protocol that earns less than inflation but holding CPI tokens. While it never makes sense to just hold a token like DAI without earning on it, CPI tokens make any DAI position that isn’t earning more than inflation obsolete. One could then approximate a rough TAM based on DAI’s $9B market cap. If CPI tokens can attract USDC and USDT users as well, then the TAM becomes even larger. Upwards of $176B when compared to the market caps of the top 5 largest stablecoins.

Another use-case of CPI tokens that makes this TAM relevant is as a medium of exchange. Similar to how it often makes more sense to LP a stETH pair over an ETH pair to maximize earnings, all else being equal it makes more sense to LP a CPI token pair over a stablecoin pair to maximize earnings. So the liquidity can be attracted. It also makes sense for people to choose to be paid in CPI tokens over stablecoins given deep enough liquidity. There is already a market in the real world for being paid in inflation-adjusted terms. Belgium has 100% of private-sector wages indexed at a health index deflator and France has 13% of its private-sector wages indexed at the National CPI excluding Tobacco. (S/o @0xhamz for educating me on these points.)

Not only do I think CPI tokens can easily attack stablecoin dominance, I think they can make the pie bigger. CPI tokens are one of those primitives that are relatively unique when it comes to retail investor mindshare. The only other similar instruments I know of are Treasury Inflation-Protected Securities (TIPS) and their derivatives which are mostly institutional products that come with their own set of tradeoffs and risks. In the same way that stablecoins onboarded a whole new cohort of users since their inception, this is exactly the right time for a primitive like this to come to market, ride the inflation narrative, and attract a whole new set of people into crypto.

The concept of CPI tokens is very much in the experimental phase. The outcomes I outline above are obvious to me but are very dependent on protocols to succeed and overcome the various hurdles to scale. Including:

Driving adoption & utility - If these tokens want to compete with stables for the end-user, they need to compete on utility as well. The only other reason I’d hold a stable position vs. a CPI token is that stables have such wide utility across DeFi. I want to be able to borrow against, lend, LP, stake, build, etc using CPI tokens. Money Lego.

Scaling deep liquidity - This type of primitive can probably see huge demand but the protocols need to build out a solution that allows the supply of these tokens to scale with demand.

A sustainable way to grow backing per token at desired rate - This, like the point above, is on the protocols to construct sustainable/scalable revenue streams and incentive mechanisms among all stakeholders.

Below we’ll look at two projects tackling this, explore their implementations, and see how they might be able to tackle some of these points.

Volt Protocol

$VOLT is a brand new type of inflation-resistant stablecoin whose price is pegged to the CPI. Recently launched on April 22nd, it was created by cofounders @OneTrueKirk and @Elliot0x; in collaboration with FEI, FRAX, and the Olympus incubator program. Its operations will be managed by the VCON DAO.

The $VOLT token can be acquired by three main venues:

1. By swapping an asset for it on a DEX like Curve or Uniswap.

2. Through their Price Stability Module (PSM). The PSM allows users to mint $VOLT in exchange for depositing stablecoins plus a 0.15% stability fee on issuance (nothing on redemption). Those stablecoins will directly be deposited into yield-bearing venues by the protocol. The PSM also allows users to then redeem stablecoins equal to their value in $VOLT, which would trigger the protocol to withdraw that stablecoin amount from their yield venues and give that to the user in exchange for $VOLT.

3. Via the FeiRari DAO Fuse Pool 8, users can mint and borrow $VOLT against an over collateralized debt position with assets like $ETH. The DAO plans to support a very wide variety of collateral types going forward. The Fuse Pool will be using the target price instead of the market price for liquidations so borrowers can’t be liquidated if $VOLT loses its peg.

While the Volt team doesn’t expect borrowing $VOLT to be a major source of supply in the market, it’s worth asking why anybody would want to borrow $VOLT? An asset designed to increase in value. There are two main reasons:

It would cost you elsewhere more than inflation to borrow under the terms you want. The protocol will control borrow interest rates but the real interest rate will be like borrowing a stable with a fixed interest rate equal to inflation + whatever the listed rate is on Fuse. So if inflation is 7.5% and the borrow interest rate is 2%, then your “real” interest rate would be 9.5%. There are definitely examples of cases where either interest rates against a collateral type are much larger than inflation or a given asset isn’t listed anywhere else as borrow collateral.

If $VOLT’s market price goes above peg. In which case, it would make sense to borrow $VOLT to short its market price, if you believe it will return to peg you: borrow $VOLT, sell for stables, buy back lower when $VOLT returns to peg, pay off the loan, keep profits.

VCON, PCV, and Protocol Mechanics

So what are the mechanics behind this and how does the VCON DAO plan to sustain 8.5% annual guaranteed growth of their token? The objective of the VCON DAO is to maintain an over-collateralized backing of each $VOLT token. Meaning there will always be more than enough money in the PSM for each $VOLT to be redeemed for stables at the target price and then some.

When a user deposits stablecoins into the PSM and receives $VOLT in return, the protocol immediately gets to work by putting those stablecoins into yield strategies. It is the objective of the VCON DAO to deploy those stables (called Protocol Controlled Value (PCV)) into strategies with the goal of returning exactly the inflation rate without incurring excess risk (a real rate of return of 0%). The DAO seems to have its sites on various yield-bearing strategies from p2p-lending, to institutional lending with partners like Maple, to delta-neutral strategies like basis-trading, to tokenizing more traditional types of yields, and more. (One interesting idea I came across was tokenizing Treasury Inflation-Protected Securities (TIPS) bonds and using that as a yield venue.)

In order to make sure PCV maintains its over-collateralization targets, the VCON DAO will be implementing a buffer cap on VOLT supply. Limiting new supply issuance if the buffer between PCV and new supply issuance is not at a comfortable level. This will apply to both new $VOLT minted on FUSE and through the PSM. This means supply will be capped to a level that the DAO thinks it can sustainably return inflation on. At launch; 40M Volt in Fuse, 10M in PSM.

So in short, assuming the DAO can find the absolute best stable yield strategies in DeFi, the formula is as such:

If DeFi stable strategies > inflation then the buffer has grown. A portion of the yield surplus will be added to PCV to grow the buffer. The offering is less attractive to more active stable farmers since they can farm better yields elsewhere.

If DeFi stable strategies < inflation then the protocol will have to dip into their buffer in order to subsidize the yields if users redeem VOLT. $VOLT is still fully backed until the buffer runs out. The offering is more attractive to more active stable farmers since this is now the best in class yield.

The point of concern is usually with the second outcome. The protocol actively recognizes that it cannot beat inflation 100% of the time. This is why it has a buffer and supply cap such that it can enforce a surplus. @OneTrueKirk takes the position that these moments will be few and far between because if there are better yields to be had off-chain, they can always be tokenized and brought on-chain. Which is why backing $VOLT using RWAs (Real World Assets) is a key focus for them.

V2 Liquid Governance

The way PCV is allocated by the DAO with Volt V2 is pretty interesting. VCON holders will be able to borrow VOLT against their VCON tokens, in exchange for a small “reserves fee”, only for the purpose of depositing that VOLT into pre-authorized yield venues (ie, fuse). The excess yield generated after inflation and their reserves fee is split between the borrower and the protocols buffer reserves. This creates a really cool skin-in-the-game dynamic where:

PCV allocators are monetarily incentivized to return not only inflation by maximizing returns beyond that and

The allocator of the VOLT is directly subject to liquidation of their VCON tokens if their strategy doesn’t meet the required collateralization ratio, which will be ever approaching due to the nature of VOLT price.

Frax Price Index

Frax Price Index is a CPI token recently launched by the Fractional-Algorithmic Stablecoin protocol Frax Finance. More information is pending a documentation update but this is what I could gather from the docs + Twitter threads.

Two main components; the $FPI token itself + the $FPIS governance token.

$FPI

Similar to VOLT’s PSM, Fraxswap will intake $FRAX stablecoin and mint an equivalent value of $FPI minus a 0.3% swap fee. Users can also redeem FPI for FRAX through Fraxswap. Pegged to CPI (using chainlink oracle funded by Volt), the promise here is that the price of $FPI will increase at the same rate as the CPI.

Initial Supply Cap: $15m. An increase to $100m was recently announced.

$FPIS

Similar to Volt, the DAO governing $FPI, holder of $FPIS, is tasked with deploying that body of FRAX into yield-bearing strategies with the aim of returning higher than inflation.

At the end of the month, if the DAO’s net return on those yield strategies was greater than inflation, all excess profits above that are distributed to $FPIS holders. If the DAO underperforms inflation, new $FPIS is issued and sold into the market to make up for the remaining yield. Diluting $FPIS holders in the process but protecting the $FPI peg.

Here’s a link to the docs that you can read when they’ve been updated. (@samkazemian said they will be updated very soon!)

Conclusion

Hopefully, it’s clear what the potential of a scalable inflation-resistant stablecoin could be. There are many use-cases of stablecoins today that can be easily replaced with CPI tokens to drive much more value.

This is not without challenges. In order for these tokens to reach a meaningful scale, this generation of projects will have to overcome a variety of hurdles. Namely, figure out a way to build a sustainable and scalable yield strategy on their PCV to consistently back their growing price peg.

Another reservation I have is that CPI tokens are still mostly dependent on the actions of the FED. The idealist in me wants to embrace the crypto ethos of no longer depending on the legacy financial system. I’d prefer a crypto-native solution. Perhaps DeFi should have its own reserve currency IMHO (is anybody building this?). But the market observer in me can clearly see the demand for stablecoins and thus CPI tokens.

All in all, the ambition of these teams is inspiring and I wish them the best of luck in their endeavors.

As always, anything I’ve said above is probably wrong and I’d be more than glad for you to tell me why! All feedback and discussions are welcome, hmu @hussufo.

gm and gn

Now we have $SPOT

OHM is the DeFi native reserve currency